A recent study conducted by University of Texas professors indicates that pig-butchering crypto scams may have siphoned off tens of billions of dollars.

A new study led by University of Texas finance professor John Griffin and graduate student Kevin Mei suggests that pig-butchering crypto scams may have drained over $75 billion from victims around the globe. The research, conducted over four years from January 2020 to February 2024, involved tracking the flow of funds from over 4,000 victims to the predominantly Southeast Asia-based scammers.

Pig-butchering scams typically begin with unsolicited text messages, enticing individuals into fraudulent crypto investments, and resulting in substantial financial losses.

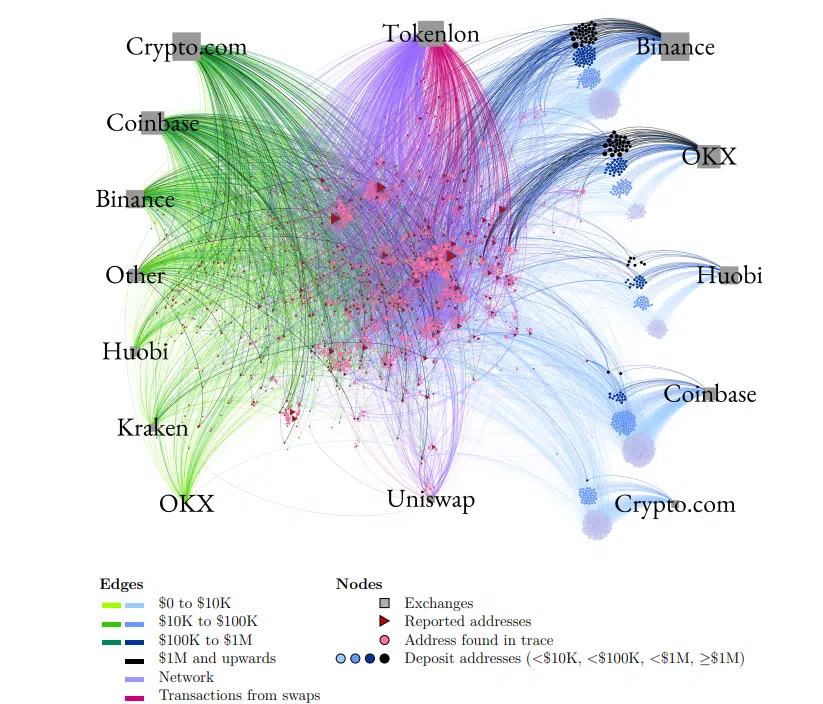

As per the research, scammers “interact freely” with major crypto exchanges, sending over 100,000 small potential inducement payments to build trust with victims. Funds exit the crypto network in large quantities, mostly in Tether (USDT), through “less transparent but large exchanges” like Binance, Huobi, OKX, Crypto.com, and Coinbase, the document reads.

While the study offers valuable insights into the scale of these scams, concerns have been raised regarding the challenges in accurately quantifying the total amount due to underreporting. For example, Tether CEO Paolo Ardoino has disputed the findings. In a commentary with Bloomberg, Ardoino emphasized the platform’s commitment to working with law enforcement to combat fraud.

“With Tether, every action is online, every action is traceable, every asset can be seized and every criminal can be caught. We work with law enforcement to do exactly that.”

Paolo Ardoino

Despite efforts by authorities and blockchain analysis firms to combat these illicit activities, criminals continue to exploit decentralized finance protocols to launder their funds.

Griffin and Mei say that the legitimate” crypto space “commonly serves as the entry and exit point to the illegitimate space,” adding that for scammers it is “the lifeblood enabling both pig butchering and modern-day slavery.” Overall, the study suggests that criminal networks are moving “substantial funds” cheaply and “without much fear of detection.”

:format(webp)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/W3R54NYJCNDPZJYRR56ZGFFBWY.jpg)

No comments:

Post a Comment